Digital KYC

A cutting-edge AI-enabled customer registration system utilizing OCR technology . Customer registration is often time-consuming. Our platform, using OCR, AI facial recognition, and real-time database verification, streamlines the process, on-boarding customers in just 15 seconds, boosting efficiency and satisfaction.

Key Features

Lightning-fast Data Collection

Our OCR platform excels in speed and efficiency. It swiftly extracts data from various documents, including IDs, passports, and utility bills, accurately capturing and securely storing information such as name, address, and date of birth within seconds.

Real-time Verification

The platform instantly verifies information by securely cross-referencing data with national databases, enhancing registration security and compliance with regulations.

High Accuracy and Reliability

The platform's OCR uses advanced deep learning models for high accuracy and reliability. It minimizes errors and eliminates manual data entry redundancies.

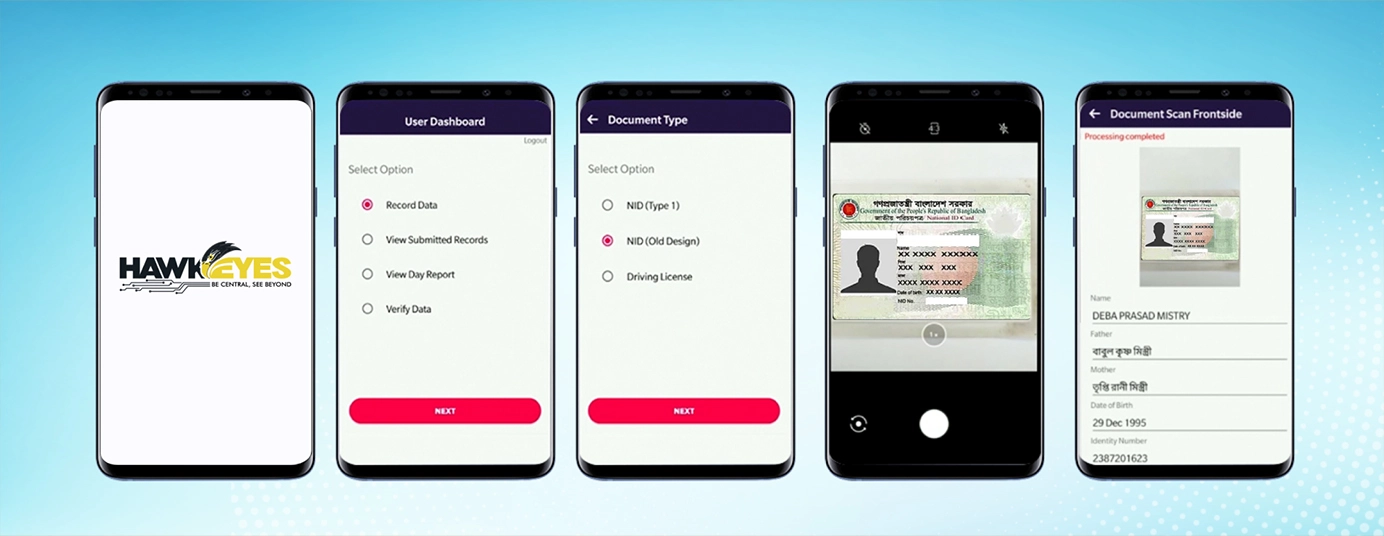

Auto NID Reader

With our solution, all the NID card can be read automatically using our mobile app and all the required data will be retrieved and saved in your secured database.

Digital KYC in Mobile app

No more paper carrying and time-consuming filling up. Our single mobile app can fill up all the required fields from KYC as well as auto-fill from NID data. The best part is, it is designed considering the capabilities of end user and hence very easy to operate. It’s faster, efficient and secured.

Capturing real Picture

Customer’s picture can be taken too with the mobile app. This feature can either be automatic or manual. Which means the app can take the pic from NID card or can take a real one instead. All at your convenience.

Biometrics Collection

With our system you also can collect actual fingerprint of each customer during registration and store those for future purposes, ensuring 100% authenticity. You can do this using the same mobile registration app.

Documentation & Historical Data Storing

Storing piles of files years after years and spend hours to search a particular KYC are things of the past. Our 360 solution will store all the records with top notch details as long as you want. Searching a file is just as simple as calling someone’s name. Still the system does not completely close the option for conventional KYC, You can simply print the KYC and hand it over to respective personnel for your use. All the KYC form will be stored just as you have in paper right now.

Auto Filled up KYC

Once the data will be automatically extracted from selected documents the system will automatically make up the bKash E-KYC incorporating all the other inputs, pictures and even biometric or signature

Complete Dashboard & Auto Analytic

All the aspects will be reported automatically with the numbers, graphs and chart on the portal. Which can be filtered as per need based on location, timeline etc.

Integration with other system like CRM & ERP

In this digital world, sky is the limit. Therefore we always keep the door open to build the bigger picture. Once you completely automate your KYC management, you can integrate it with the CRM, or ERP as well.

All the report, E-KYC and supporting Docs can be downloaded anytime

This feature allows users to easily access and save detailed reports from our platform in various formats for offline use or sharing. Stay informed and make better decisions with our 'Download Reports' feature.

Key Benefits

Your Vision

our process

Stellar Results!

At HawkEyes, your vision is our compass. Through our proven process, we navigate challenges, crafting stellar results that reflect our commitment to excellence!

Contact Us